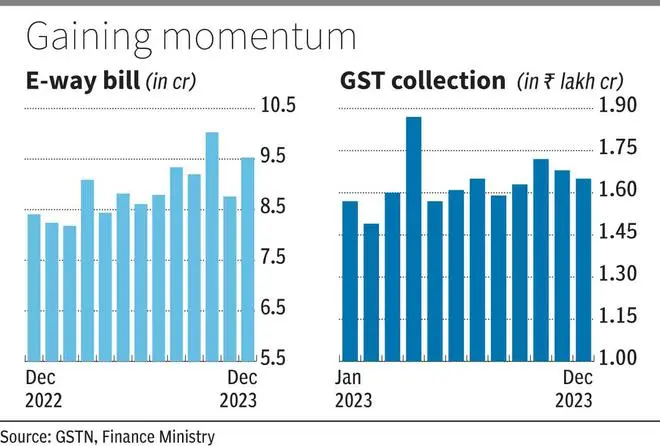

The number of e-way bills generated in December were 9.52 crore, the second highest monthly figure so far. The e-way bills generated in December may have some impact on GST collections in January and February.

After touching a record high of 10.03 crore in October 2023, the e-way bills declined sharply to 8.75 crore in November.

The December figure could be a result of high year-end dispatches, especially in electronic items and automobiles. Besides, higher compliance contributed to high e-way bill generation. “The surge in the e-way bill generation can be attributed to increased consumption which indicates the early trend of growth in economic demand and supply chain,” Saurabh Agarwal, Tax Partner with EY said. Further, the effects of this trend would be subsequently reflected in macroeconomic indicators, albeit with some time lag. The increased e-way bill generation is also a result of enhanced scrutiny by revenue authorities and improved compliance by taxpayers.

An e-way bill is an electronic document generated on a portal, evidencing the movement of goods and indicating whether tax has been paid or not. As per Rule 138 of the CGST Rules, 2017, every registered person, who causes the movement of goods (which may not necessarily be on account of supply) of consignment value of more than ₹50,000 (can be lower for intra-state movement) is required to generate an e-way bill.

Gunjan Prabhakaran, Partner with BDO India said increase in e-way bill generation numbers is an indicator of two trends. -- the first is improved compliance and second, increase in economic activity. Both of these should ultimately lead to increase in tax collections. Tanushree Roy, Director, Nangia Andersen India said year-end impetus on e-waybill generation can be attributed to year-end discounts offered on sales of automobiles, electronic goods, garments by manufacturers. Auto Sellers prefer clearing off their stocks within the same year and offer attractive discounts to liquidate their inventory, leading to high year-end sales.

“Similarly, in case of electronics, year-end discounts are offered to clear off stock leading to increased sales. At the same time, discounts offered by the garment industry for winter clearance sales also drive sales of garments, leading to increased movement of goods and issuance of way-bills,” Roy said.

What is the impact of higher e way bill generation on tax collection? According to Prabhakaran, overall increase in GST collections happens when there is an increase in demand by the end consumers, backed by better compliance. “If the increased e-way bill generation is on account of higher sales to dealers/stockists, without corresponding increase in sales to end consumers, the GST revenue would remain stagnant because the GST paid by the companies would be available as input tax credit to the dealers/stockists, resulting in no net increase in GST collections,” she said.

Agarwal had a slightly different take. “The sustained momentum in e-way bill generation is expected to be mirrored in the GST collection figures for the same month, which will be reported in January 2024. The increased collections would necessarily provide support to the government’s revenue to help meet its fiscal deficit target,” he said.