ICICI direct’s “Market Strategy 2024” report, citing robust corporate earnings growth, healthy GDP, and favourable commodity and likely rate cuts, lays out reasons to be optimistic on prospects for Indian markets in 2024. Here are five charts that bring out the various high growth indicators from their latest research report, supporting their outlook.

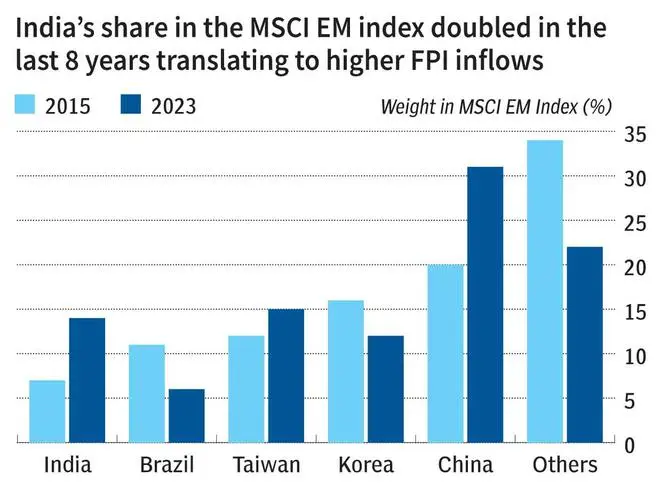

1) FPI flows

The net FPI inflows in 2023 totalled $21 billion while the other emerging markets have experienced minimal inflows.

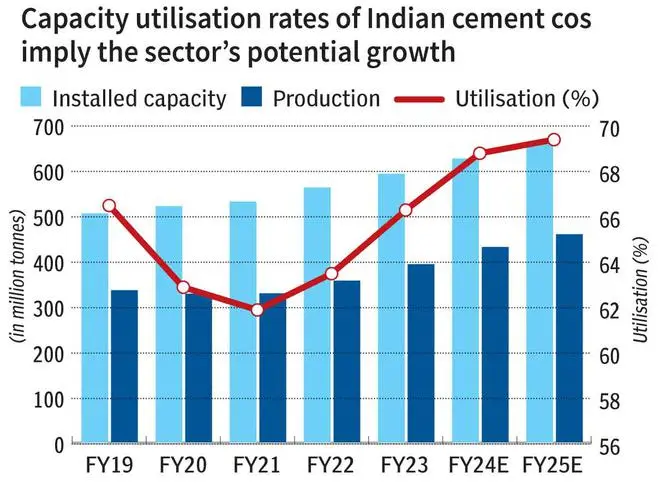

2) Cement companies are bullish on capex

During the fiscal years FY23-25E, cement companies are projected to augment their capacity by around 35 million metric tons per annum, a substantial increase compared to the 19 million metric tons added between FY19-22.

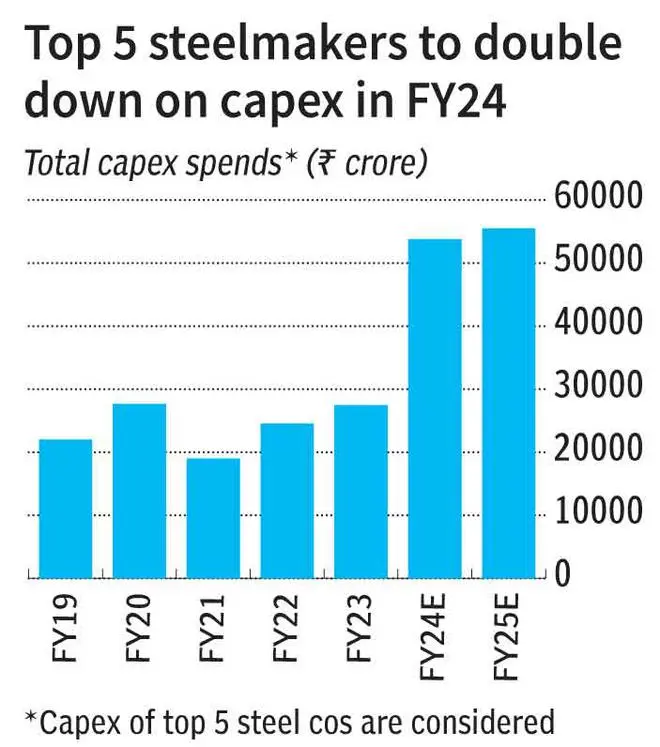

3) Steel companies are bullish too

It is important to highlight that India’s National Steel Policy has set a target of achieving a crude steel capacity of 300 million metric tons by 2030, which partly explains the significant estimations of annual capital expenditure growth observed among the top five steel manufacturers in FY23-25E.

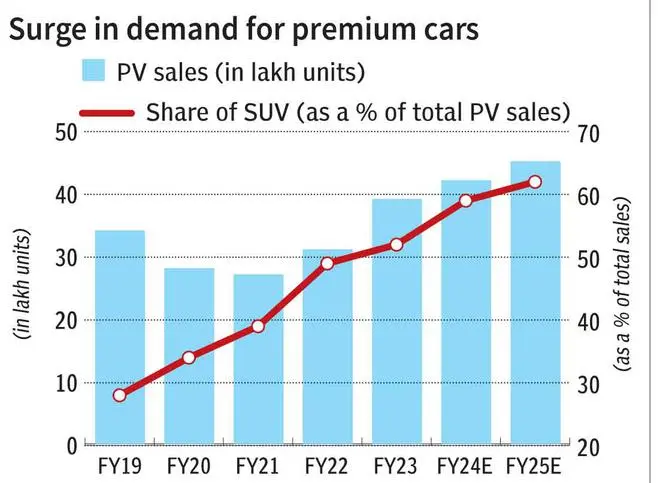

4) Auto sales trending well

Passenger Vehicle (PV) sales in FY23 have surpassed their pre-covid peaks and are expected to increase further in FY24-25.

5) Real Estate faring well

Real estate sales are expected to remain to robust on account of implementation of Real Estate Regulatory Authority (RERA) and strong end user housing demand, as reported by ICICI direct.