PSU stocks have seen a sharp rally this year as BSE PSU Index rose by around 46 per cent on a year-to-date basis. This has possibly been driven by rerating due to attractive valuation, and increased capex spending by the government. One PSU player that was part of the rally is engineering consultancy firm, Engineers India Ltd (EIL).

Since our Accumulate rating on Engineers India in bl.portfolio edition dated January 15, 2023, the stock has run up around 85 per cent. Previously the rationale for such rating was attractive valuation, high dividend yield, strong balance sheet and healthy order book despite growth being a bit slow. There has been a sharp run-up in the stock, with valuation expanding from one-year forward P/E of around 11 times to 18 times since then. While the balance sheet and order book still remain strong, investors can book profits in the stock as investment thesis has already played out due to spike in stock price and valuation.

Business

Conferred with Navratna status and controlled by the Ministry of Petroleum, Engineers India is primarily engaged in providing engineering consultancy, EPC (engineering, procurement and construction) and project management services in the oil and gas and petrochemicals space. Here, the company is present in the entire hydrocarbon value chain (upstream, midstream and downstream).

In the consultancy segment, EIL provides services such as conceptualise, design, engineer and construct projects as per client’s specific requirements while projects in its turnkey segment require the company to manage end-to-end engineering and even EPC part.

Though consultancy segment used to have a higher share historically, i.e. 70-80 per cent, the company now generates 45 per cent and 55 per cent of operating revenue from consultancy and turnkey (EPC) segments respectively. In the turnkey segment, it earns revenue on a cost-plus basis and management has guided sustainable EBIT margins of 3 per cent in the segment while it expects the same for consultancy segment to be 25-27 per cent on a sustainable basis.

Further, about 90 per cent of company’s business is based in the domestic market while the rest comes from its consultancy assignments in countries such as Nigeria, the UAE, Oman and Mongolia.

EIL has a track record of being involved in setting up majority of refineries and petrochemical complexes in India. Over the years, the company has been preferred partner for oil and gas PSUs, such as ONGC, BPCL and HPCL. While keeping Oil and Gas at core, it has been able to diversify its operations into sectors such as Fertiliser, Power, Mining & Metallurgy and Infrastructure. Further, EIL is exploring opportunities in other sectors such as green energy, bioethanol, coal gasification, steel emission control and green hydrogen.

Financials and valuation

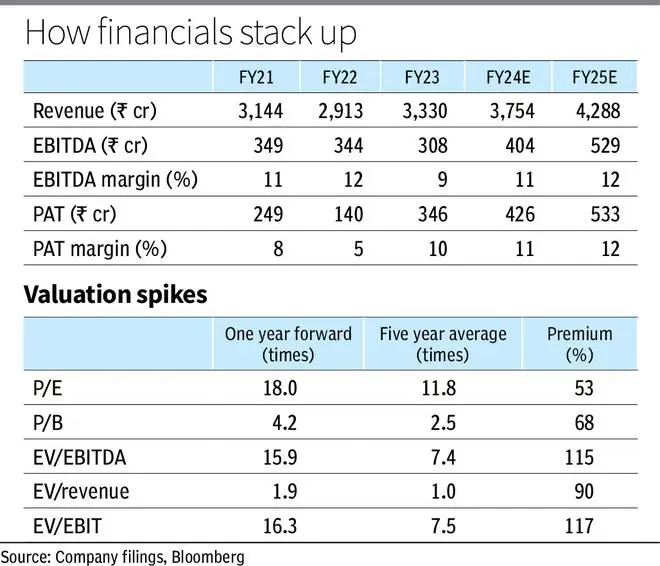

During H1FY24, the company achieved flattish revenue at around ₹1,606 crore on account of weaker execution. While the revenue from consultancy segment increased by roughly 2 per cent, that of turnkey segment fell by around 1.3 per cent. Its EBITDA during the period grew massively YoY by around 85 per cent to ₹176 crore, leading to margins expanding from 5.7 per cent to 10.5 per cent.

However, such EBITDA growth was largely supported by one-time liquidity damage settlement of around ₹45 crore. Furthermore, it has also received ₹56 crore in Q1FY24 on account of settlement of past claims in consultancy segment and dividend income of about ₹14 crore, which has led to improvement in net profit by about 59 per cent during H1FY24, to ₹210 crore.

Despite no growth during H1FY24, the management has maintained its guidance of 10 per cent revenue growth during FY24, which might be on account of expectation of higher execution during H2FY24.

The company has a strong balance as it is debt-free and cash-rich, with cash balance of around ₹1,096 crore.

The stock is trading at a one-year forward P/E (Bloomberg consensus estimates) of around 18 times i.e. 56 per cent higher its five-year historical average of 11.5 times. Also, since our last recommendation on the stock, dividend yield has halved from 4 per cent to 2 per cent on account of spike in the stock price.

Outlook

The company has a strong order book of around ₹8,188 crore as of H1FY24 of which 94 per cent is from oil and gas space. This implies the order book to revenue of around 2.5 times, indicating strong revenue visibility. The order book comprises 59 per cent of consultancy-based orders, the rest are turnkey. It remains to beseen if the management is able to improve the execution of consultancy projects which is high-margin business for the firm.

The company received order inflows of around ₹2,405 crore during H1FY24 and the management guides for total inflows to remain same during FY24 as it was during FY23 at around ₹4,700 crore.

The company’s growth primarily depends on the capex made by the oil and gas companies, which could be less compared toFY23. The concern might be compensated by EIL’s high order book.