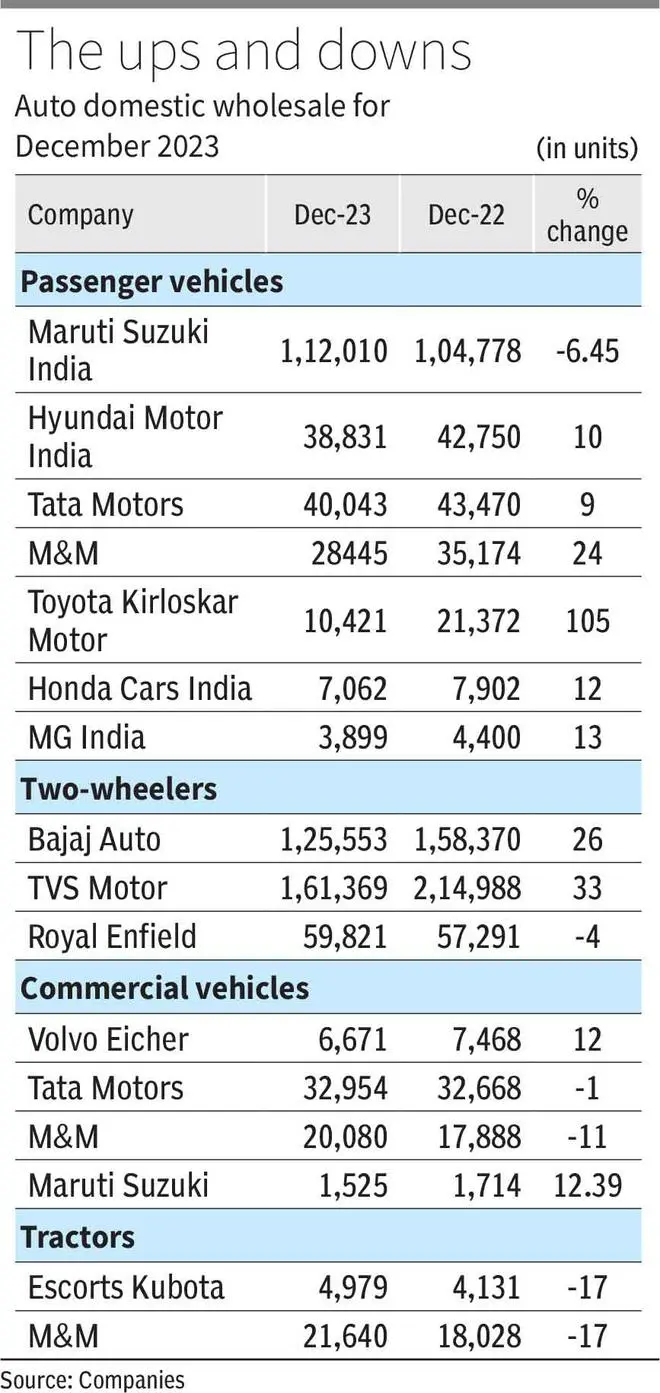

The passenger vehicles (PVs) and two-wheeler wholesales (dispatches to dealers) continued their growth momentum in December and ended the year in a positive note, 2023 being the unique year for PVs where sales grew every month.

However, India’s largest car maker, Maruti Suzuki India Ltd (MSIL), recorded a dip in its sales figures in December 2023 compared with the same month in 2022. According to the data, sale for PVs was 1,04,778, which was less than last year’s 1,12,010 units. The dip was witnessed across PV segments except utility vehicles.

PV segment

In the PV segment, the wholesale in the industry was recorded at 2,87,904 units, which was the highest-ever December so far. The previous highest was 2,76,000 units in December 2020. Also, this indicates a growth of 4.4 per cent over last year’s 2,75,653 units.

“This was one of those very unique calendar years where all the 12 months were the highest ever... For Maruti Suzuki, number in PVs was 1,04,778 which was a negative and less than last year’s number of 1,12,010 units,” Shashank Srivastava, Senior Executive Officer, MSIL, told reporters.

However, the retail sales numbers was better, as the company’s strategy was to bring the stock down substantially and it has been successful in doing that.

“Maruti Suzuki’s retail number is 2,26,428 against 2,01,697 of last year, that is a growth of 12.3 per cent over last year. This also, of course, is the highest-ever retail of Maruti Suzuki in any year in any month,” Srivastava said, adding that overall, retail in the industry, by estimates, is 4,42,800 units during the month.

“This will be the highest-ever retail in any month in any year in the Indian auto industry’s history. It is a growth of 7.8 per cent over last year. Last year, industry retails were 4,10,900 units,” he added.

HMIL vs Tata

For Hyundai Motor India (HMIL), the company recorded a growth of 10 per cent year-on-year (y-o-y) in its domestic wholesale sales to 42,750 units during the month (38,831 units).

In the calendar year (CY), the company recorded sales of six lakh units (5,52,511 units), a growth of 9 per cent y-o-y.

“HMIL has not just kept pace but surpassed industry growth (estimated at around 8.2 per cent), a testament to customers choosing brand Hyundai as their preferred mobility brand. Also, in 2023, we proactively expanded our annual production capacity by 50,000 units to meet the increasing demand from our customers,” Tarun Garg, Chief Operating Officer, HMIL, said.

Similarly, Tata Motors reported a 9 per cent y-o-y growth in its sales to 43,470 units in December 2023 (40,043 units). Interestingly, this is the second year that the company’s December sales are more than Hyundai Motor India. In December 2022 also, Tata Motors’ sales were higher than Hyundai Motor’s.

“Coming off a high base, the industry recorded a single-digit growth overall with the key highlight of this moderate rise being the sharp growth registered in emission-friendly product categories. Both EV and CNG segments posted growth greater than 90 per cent and 25 per cent respectively, signalling a growing preference for green and smart technologies by Indian customers,” Shailesh Chandra, Managing Director, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, said.

Two-wheelers and CVs

In the two-wheeler segment, Bajaj Auto and TVS Motor have recorded growth on the yearly basis, while Royal Enfield reported a decline of 4 per cent y-o-y in its December sales.

In the commercial vehicle segment, there was a mixed trend in the sales during the month, while in tractor segment, both M&M and Escorts Kubota both reported a decline of 17 per cent, respectively.