Central GST Administration has detected over 5,000 cases of GST registration by misusing PAN/Aadhaar details of other people to claim ITC during July 1, 2017 to June 30, 2023. It involves evasion of over ₹27,000 crore, data presented by Finance Ministry in Lok Sabha on Monday showed.

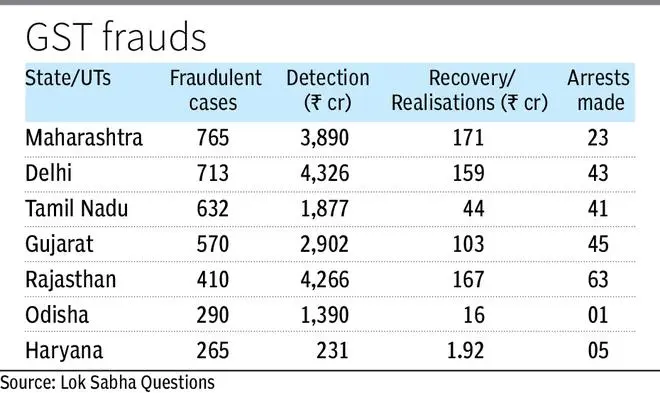

While Maharashtra tops the list in number of cases, Delhi leads in terms of amount fraudulently availed and detected. Gujarat has maximum number of arrests.

In a written reply, Union Minister of State for Finance Pankaj Chaudhary Informed the Lok Sabha that between July 1, 2017 and June 30, 2023, number of fraudulent cases of GST registration by misusing PAN/Aadhaar details of other people to claim ITC was 5,070. In all these cases, amount of over ₹27,000 crore detected, out of which ₹923 crore recovered. Total of 331 arrests have been made, he added.

Also read: Nearly two-third income tax return filers have zero tax liability

Further, he highlighted that as a result of special drive against fake registration by Centre and States, started on May 16, total of 9,369 entities identified. The drive identified detection of ₹10,902 crore. However, total recovery was just ₹45 crore and 7 persons were arrested, the Minister said. He also gave details about measures for curbing fake invoices.

Now, there is system for one time password (OTP) based verification of permanent account number (PAN) on the mobile and email address linked with PAN. Further, trial for biometric-based Aadhaar authentication of registration applicants is going on and soon it will be implemented at national level. The rule also provides for physical verification in high-risk cases, even when Aadhaar has been authenticated.

Tracking risky taxpayers

The department is using robust data analytics and artificial intelligence to identify and track risky taxpayers and detect tax evasion. It is also sharing of data with partner law enforcement agencies for more targeted interventions.

An amendment has been made in GST rules to provide for requirement of bank account furnished as a part of registration process to be in the name of the registered person and obtained on PAN of the registered person and also linked with Aadhaar in case of proprietorship firm.

Also, the GST Council in its 50th meeting recommended further amendment in Rule 10A to provide that the details of bank account will be required to be furnished within 30 days of grant of registration or before filing of GSTR-1, whichever is earlier.

Pilot geotagging

The tax department has also launched a pilot geotagging where the plan is to geotag the address so that the exact location of that address is available. In the past, the department found that an office place is created only for verification and subsequently when officers go there, they find there is no longer an office.

According to the GST portal, functionality for geocoding the principal place of business address (the process of converting an address or description of a location into geographic coordinates) is available for taxpayers registered in Delhi and Haryana; it will gradually be opened for taxpayers from other States and UTs. This feature aims to ensure the accuracy of address details in the goods and services tax network records and streamline the address location and verification process.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.